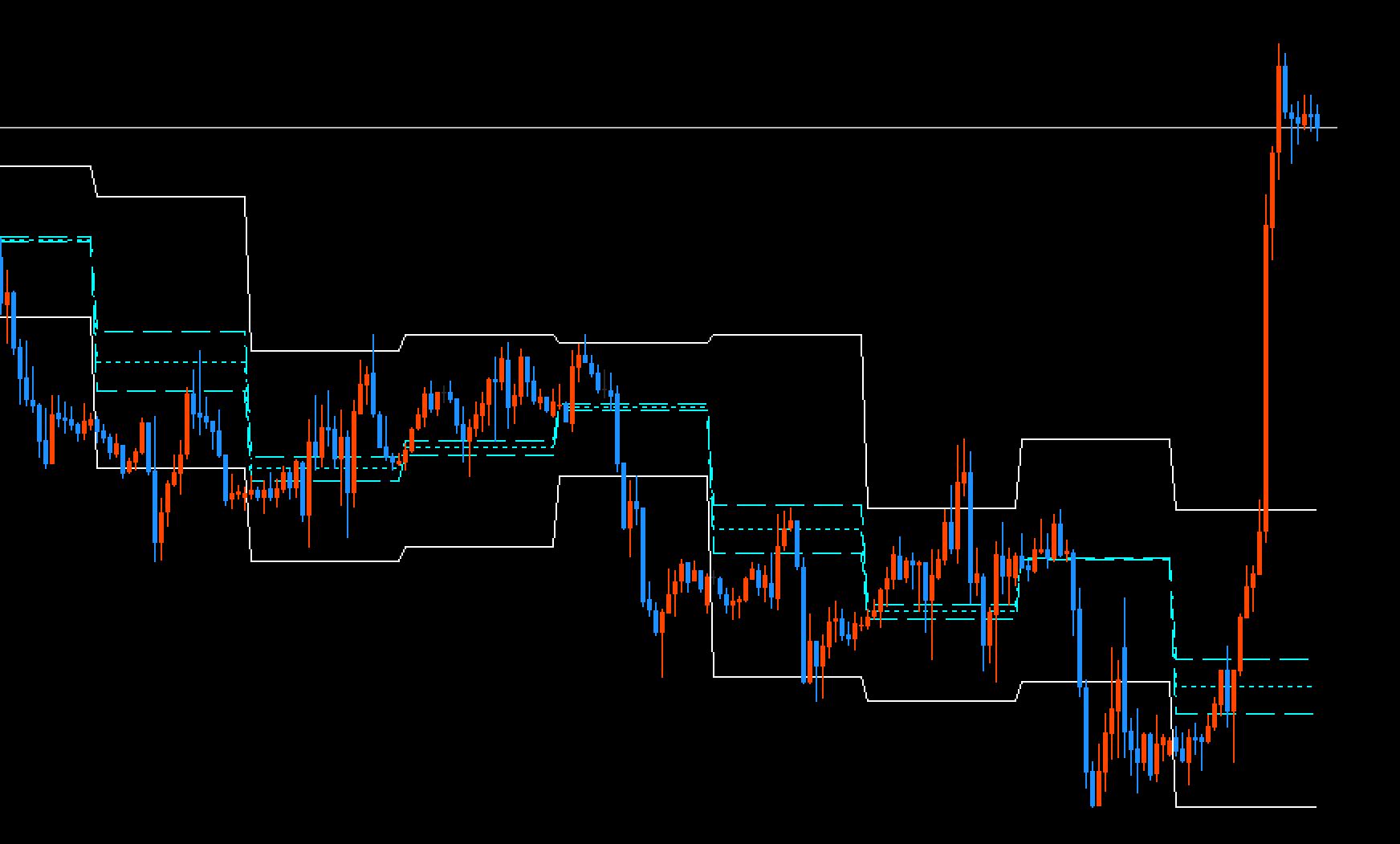

The Pivot Range and Previous High-Low indicator plots a dynamic price channel, guiding traders through key support and resistance zones in all trading sessions.

By applying this indicator on MT4, traders can align their strategies with significant price levels and critical pivot points. Trading positions can be taken based on various chart levels. Due to its adaptability and ease of use, it is popular among daily traders in both forex and stocks.

Moreover, the High-Low channel, a market breadth indicator, assesses the strength or weakness of an index. It is calculated by dividing current highs by the sum of new highs and new lows, multiplying the result by 100, and then plotting the value against a 10-day SMA to smooth out the results.

How to Identify Potential Buy-Sell Signals Using the Pivot Range and Previous High-Low MT4 Indicator

The Pivot Range and Previous High-Low shows the current pivot level that serves as an intraday price breakout zone. When the price exceeds the pivot level, it indicates a bullish market trend, signaling buy opportunities. Conversely, focus on potential sell signals when the price falls below the pivot line.

The higher and lower bands of the price channel guide you through the market’s maximum pullback areas. If the price fails to surpass the channel’s support or resistance, it provides valuable hints on overbought or oversold markets and potential trend reversals.

In the above 4-hour EURUSD chart, the price was initially in an uptrend but lost momentum once it fell below the pivot range. Later, the price dropped below the channel’s low, confirming a downtrend after the bearish breakout.

Trading based on breakouts at the channel’s support or resistance offers better confirmation of current market momentum. However, it can reduce your profit margin due to late entry. In such cases, you can also look for buy-sell signals close to the pivot line.

For instance, if the price moves above the pivot range, it signals a bullish market trend. After receiving trend confirmation, wait for a pullback near the support to go long. When going long, place a stop-loss (SL) below the channel-low. Conversely, set the SL above the channel-high for short entries.

Conclusion

The Pivot Range and Previous High-Low is a versatile MT4 indicator that facilitates a dynamic trading approach on MTF charts. Its dynamic price channel and pivot lines provide further confirmation while anticipating buy-sell opportunities. Additionally, it can be integrated with existing trading strategies to enhance trading accuracy.